NPV/rNPV:

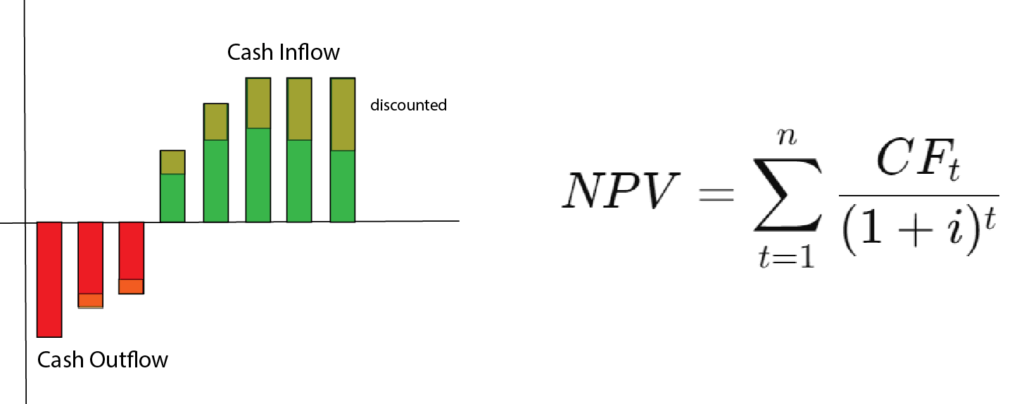

Net Present Value (NPV) is a financial tool used to assess the profitability of an investment or project. It helps determine whether an investment is worthwhile by comparing the present value of future cash flows to the initial cost.

A simplified breakdown:

Future Cash Flows:

Estimate the expected cash inflows (money coming in) and outflows (money going out) over the life of the investment. E.g. future revenues after a drug is on the market (money coming in) or project costs for your clinical trial (money going out).

Important is Discounting:

Money today is worth more than money tomorrow. This is due to factors like inflation and the opportunity cost of money. This is why in the calculation you need to discount future cash flows to their present value using a discount rate (often the company’s cost of capital/interest rates). This process adjusts future cash flows to reflect their current value.

Calculating NPV:

From today onwards add and subtract all cashflows (including discounted future cash flows) and you get the NPV. Already spend money (sunk costs) is ignored, because it is irrelevant to future decisions: Sunk costs are historical costs that have no bearing on future cash flows.

Risk-Adjusted NPV (rNPV) is a refinement of the traditional Net Present Value (NPV) method that explicitly accounts for the risk associated with future cash flows (some projects have higher risks than others). A drug development project e.g. has a high probability through the different phases to never reach the market. These probabilities can be used to additionally discount future cash flows.

If a project has a positive NPV, it means the present value of its future cash inflows exceeds the initial investment.